Hardware is the CAC. Subscription is the Profit

Most hardware founders think subscriptions are an "ownership tax" that customers hate. They're right to worry, but completely wrong about the solution.

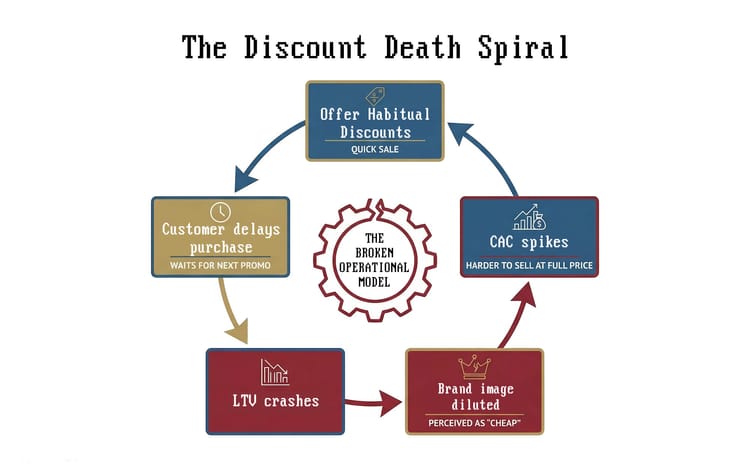

Here's the uncomfortable truth: your CAC is killing you not because marketing is expensive, but because your LTV is too low.

Let's run the numbers.

Typical hardware-only model (simplified unit economics example):

- Product price: $299

- COGS: $120

- Gross margin: $179

- CAC: $180

- Contribution margin after CAC: -$1

You're underwater on day one.

Now add an optional subscription at $9.99/month:

- Same product: $299 (margin: $179)

- Subscription adoption: 40% of customers

- Average subscription lifetime: 24 months

- Additional LTV per customer: $96 (40% x $9.99 x 24)

- Less subscription costs: ~$29 (40% x $3.00 x 24)

- New CM after CAC: $67 per customer

Same CAC. Huge improvement in economics.

But it won't work if your subscription feels like ransom notes: "Pay us monthly or your $400 device becomes a brick." Provide value instead.

The four non-negotiables for hardware subscriptions:

- The subscription must be optional.

Your core product must deliver its primary value without any recurring payment. - The base product must work excellently on its own.

If someone buys your device and never subscribes, they should still love it and recommend it to others. - The pricing must feel fair.

Customers are smart: they understand cloud costs, AI processing, and ongoing development in general. Don't be greedy and charge for what can be provided for free. Bad example: BMW's heated seats subscription. - The subscription must provide so much value that customers genuinely want it.

Think Tesla's FSD or Ring's video history. The subscription should make customers think "I can't imagine using this product without these features."

When you implement this, your hardware becomes a customer acquisition tool for your subscription business with SaaS margins.

Suddenly that $180 CAC looks reasonable because you're building a $500+ LTV relationship.

Your product marketing shifts from "buy this device" to "join this experience." Your retention metrics become more important than your launch day sales. Your investors stop asking about margins on hardware and start asking about MRR growth.

The bottom line: hardware-only businesses optimize for the wrong metric. They obsess over reducing CAC when they should be engineering reasons for customers to stay.

Build a product people love. Then build a subscription people crave.

What’s the best (or worst) hardware subscription you’ve seen recently?

I help hardware startups fix their unit economics before they run out of runway. If your CAC/LTV ratio keeps you up at night, let's talk.